Embolic Protection Devices Market to Reach USD 1,401.6 Million by 2034 at 8.1% CAGR (2026-2034)

The global embolic protection devices market is dominated by leading companies such as Medtronic, Abbott, Edwards Lifesciences, and Cardinal Health and more.

North America held the dominant share in 2024, valued at USD 225.4 million, and also maintained its lead in 2025, with USD 243.8 million.”

PUNE, MAHARASHTRA, INDIA, February 1, 2026 /EINPresswire.com/ -- The Embolic Protection Devices Market is gaining significant traction globally, driven by the rising prevalence of cardiovascular diseases, increasing adoption of minimally invasive procedures, and continuous technological advancements in interventional cardiology. In 2025, the global embolic protection devices market was valued at USD 695.2 million. The market is projected to grow from USD 749.7 million in 2025 to USD 1,401.6 million by 2034, exhibiting a compound annual growth rate (CAGR) of 8.1% during the forecast period.— Fortune Business Insights

Embolic protection devices are specialized medical tools used during vascular and cardiac interventions to capture or deflect embolic debris released into the bloodstream. These devices help prevent serious complications such as stroke, myocardial infarction, and organ damage during procedures involving diseased or calcified blood vessels. Commonly used during angioplasty, stenting, and transcatheter interventions, embolic protection devices enhance procedural safety and improve clinical outcomes. Their role has become increasingly important with the growing number of complex cardiovascular and peripheral vascular procedures performed worldwide.

Get a Free Sample PDF-https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/embolic-protection-device-market-112518

Market Growth Drivers

Several key factors are contributing to the steady expansion of the embolic protection devices market:

Rising burden of cardiovascular diseases: Increasing incidences of coronary artery disease, carotid artery disease, and valvular heart conditions have led to higher demand for interventional procedures requiring embolic protection.

Growth of minimally invasive procedures: The preference for minimally invasive treatment options continues to rise due to reduced hospital stays, lower complication rates, and faster recovery times.

Expansion of healthcare infrastructure: The growing number of hospitals, ambulatory surgery centers, and catheterization laboratories has increased the volume of procedures that utilize embolic protection devices.

Technological advancements: Continuous innovation in device design, filtration efficiency, and ease of deployment has improved clinical adoption.

Market Restraints

Despite favorable growth prospects, the market faces certain challenges:

Limited reimbursement policies: In some regions, inadequate reimbursement coverage for embolic protection procedures restricts broader adoption.

Lack of awareness in emerging markets: Limited awareness regarding the benefits of embolic protection devices and a shortage of skilled professionals may hinder growth in developing regions.

Market Trends

The embolic protection devices market is witnessing several evolving trends that are shaping its future trajectory:

Increasing usage in saphenous vein graft interventions: These devices are increasingly adopted during coronary bypass graft procedures to reduce embolic complications.

Rising clinical acceptance: Growing evidence supporting improved patient outcomes has led to wider adoption by interventional cardiologists.

Product innovation: Manufacturers are focusing on multifunctional and integrated device designs to enhance procedural efficiency.

Market Segmentation Analysis

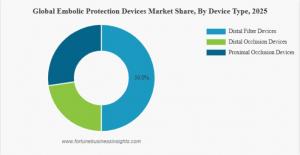

By Device Type

Based on device type, the market is segmented into distal filter devices, distal occlusion devices, and proximal occlusion devices.

The distal filter devices segment held the largest market share in 2025 due to their ease of use, high debris capture efficiency, and wide clinical applicability. Distal occlusion devices are also expected to experience notable growth during the forecast period.

By Procedure

By procedure, the market includes percutaneous coronary intervention, carotid artery stenting, peripheral vascular interventions, and others.

The carotid artery stenting segment dominated the market in 2025, supported by an increasing number of carotid revascularization procedures and growing awareness of stroke prevention.

By End User

Based on end users, the market is categorized into hospitals and ambulatory surgery centers, and standalone catheterization laboratories.

The hospitals and ambulatory surgery centers segment accounted for the largest share in 2025, driven by high procedure volumes and the availability of advanced infrastructure.

Regional Market Insights

Regionally, the embolic protection devices market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America: North America dominated the global market in 2025 with a valuation of USD 243.8 million, supported by advanced healthcare systems and a high number of interventional procedures.

Europe: Europe is expected to witness steady growth due to the strong presence of established medical device manufacturers and increasing adoption of advanced cardiovascular treatments.

Asia Pacific: Asia Pacific is projected to emerge as a fast-growing region, driven by rising healthcare investments, growing patient populations, and improving access to interventional care.

Speak To Analyst-https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/embolic-protection-device-market-112518

Competitive Landscape

The embolic protection devices market is moderately consolidated, with several leading players focusing on innovation, strategic collaborations, and product expansion.

Key companies operating in the market include:

Medtronic

Boston Scientific Corporation

Edwards Lifesciences Corporation

Abbott

Cardinal Health

Transverse Medical Inc.

L. Gore & Associates, Inc.

Contego Medical, Inc.

Cordis

These companies continue to invest in research and development to enhance product performance and expand their global footprint.

Key Industry Developments

October 2025: Medtronic launched the full commercial distribution of the Neuroguard IEP System, featuring a three-in-one design that integrates a stent, post-dilation balloon, and embolic filter.

October 2025: AorticLab received FDA approval for an investigational device exemption for its FLOWer system, a full-body embolic protection device used during transcatheter intracardiac procedures.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.