Corporate Sustainability: Emissions, Governance, and the Energy Transition

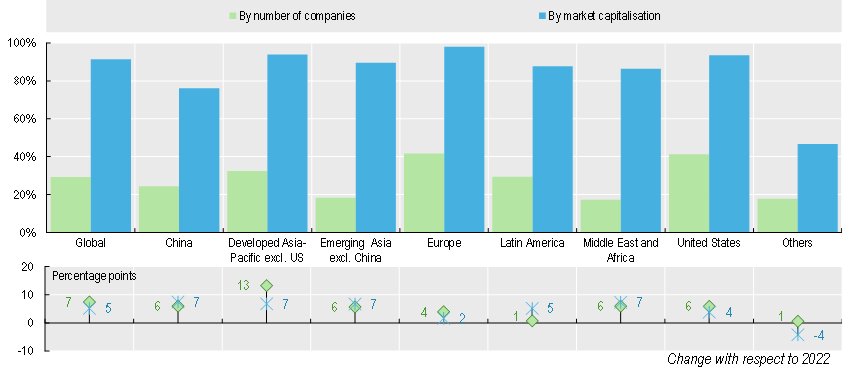

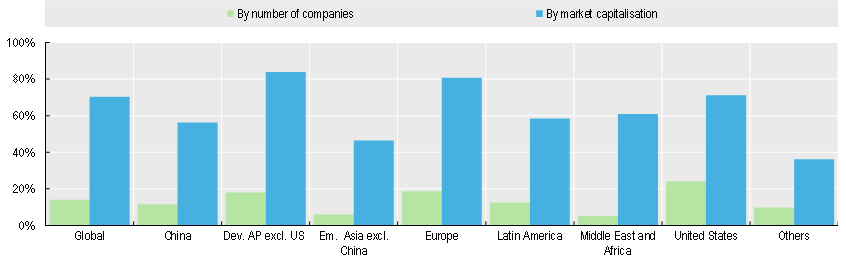

Sustainability-related disclosure. Over the past two years, sustainability-related disclosure has expanded, rising from companies representing 86% of global market capitalisation in 2022 to 91% in 2024. This reflects continued demand for such information from investors. However, the absolute number of companies disclosing sustainability information – 12 900 – remains only a moderate share of the 44 152 listed companies worldwide. Energy companies have the highest rate of disclosure, covering 94% of the industry’s market capitalisation; the real estate sector has the lowest share at 78%.

![]() Disclosure of sustainability-related information by listed companies in 2024

Disclosure of sustainability-related information by listed companies in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

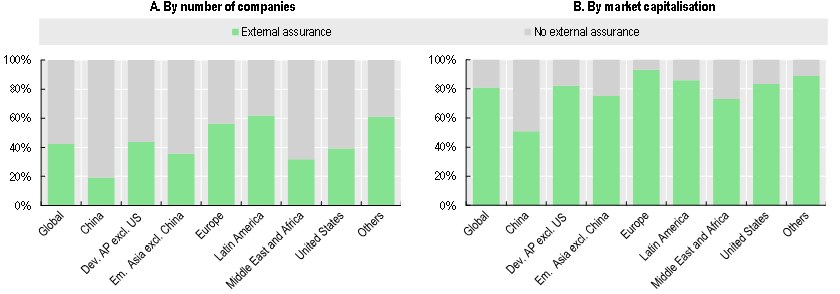

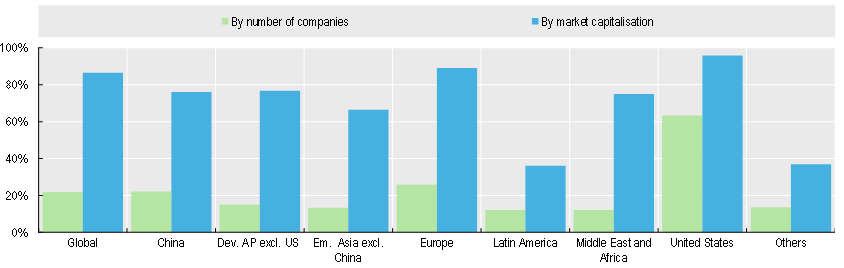

Third-party assurance. Of the 12 900 companies that disclosed sustainability-related information in 2024, 42% obtained assurance of the information by an external service provider. Most companies rely on limited assurance (56%), while far fewer rely on reasonable assurance (17%). The adoption of the International Standard on Sustainability Assurance (ISSA) 5000, finalised in November 2024, is timely. Its adoption by many jurisdictions could strengthen confidence in sustainability reporting and ensure a common understanding of what “limited” and “reasonable” assurance mean across jurisdictions.

Share of companies with assurance of the sustainability-related information in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

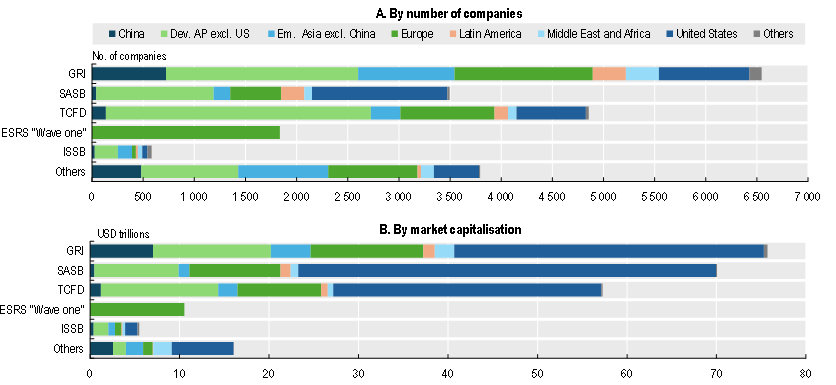

Sustainability-related disclosure standards. Globally, 582 companies use the International Sustainability Standards Board (ISSB) standards, either stating a partial alignment, or asserting compliance, still well below the number of companies using the TCFD recommendations (4 857) or SASB Standards (3 497), which provided the foundations for the ISSB’s standard-setting work. The use of the European Sustainability Reporting Standards (ESRS) remains limited, reflecting their recent adoption in July 2023. Strengthening interoperability among frameworks is critical to reducing compliance costs for companies operating across jurisdictions and to enhancing the comparability, reliability, and decision usefulness of sustainability-related information.

Use of sustainability standards by listed companies in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

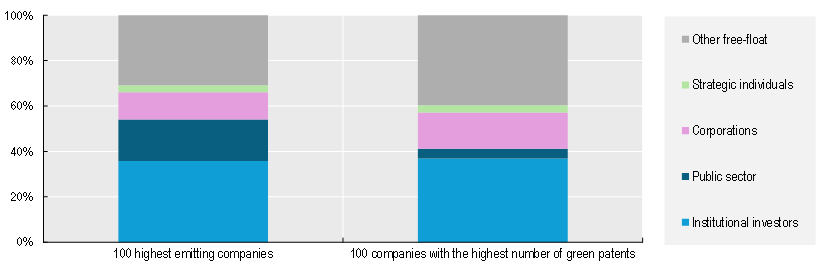

Shareholders and institutional investors. Among the 100 listed companies that disclose the highest GHG emissions, 35 are from the energy industry. Institutional investors hold the largest share of equity in these 100 companies (36%), followed by the public sector with 18%. While the adoption of existing green technologies by high-emitting companies is essential for the transition to a low-carbon economy, the development of new technologies will also be necessary for a successful transition. Institutional investors own 37% of the equity in the 100 companies with the highest number of green patents, and the public sector a much smaller portion (4%).

Ownership of top 100 GHG-emitting and green-innovation companies, 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

The board of directors. In 2024, companies representing 70% of global market capitalisation reported that their board of directors oversees climate-related issues. This is an increase from 53% in 2022 and surpasses the share of companies – representing 65% of market capitalisation – for which climate change is considered a financially material risk. This is a notable development, underscoring the growing recognition by boards of directors of climate change as a core financial and strategic matter.

Board-level oversight of climate-related issues in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

The interests of stakeholders and shareholder engagement. Globally, more than 9 600 companies – representing 86% of market capitalisation – disclosed policies on shareholder engagement in 2024. While the disclosure of such policies does not by itself guarantee effective engagement, it signals a willingness by companies to facilitate dialogue with shareholders – particularly where disclosure is not mandated by regulation. To promote value-creating co-operation with employees in particular, companies may establish mechanisms for participation, such as workers’ councils or employee representation on boards. Employee board representation accounts for almost 5% of companies globally, highest in China and Europe.

Policies on shareholder engagement in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

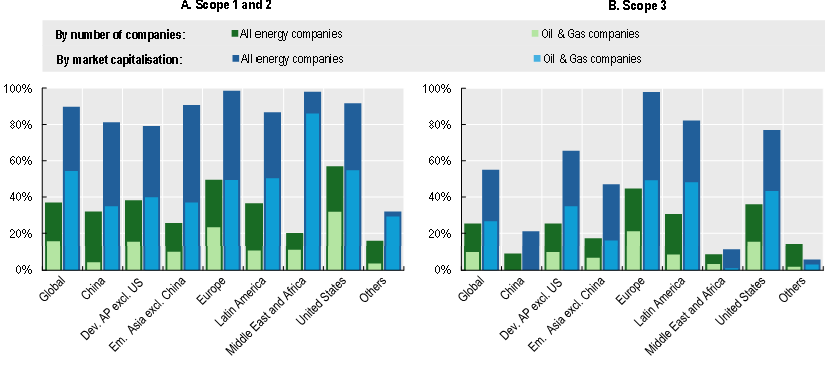

The energy sector’s climate-related disclosure. The energy sector – encompassing the oil, gas, coal and electric power industries – is both a pivotal driver of clean energy deployment and the single largest source of greenhouse gas emissions, accounting for almost a third of total emissions disclosed by listed companies. Disclosure of scope 1 and 2 GHG emissions is relatively high in the energy sector, covering 90% of market capitalisation. However, scope 3 disclosure remains limited, particularly in Emerging Asia and the Middle East and Africa, where fewer than half of companies by market capitalisation report such data.

Listed energy companies – disclosure of scope 1 & 2 and scope 3 emissions in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

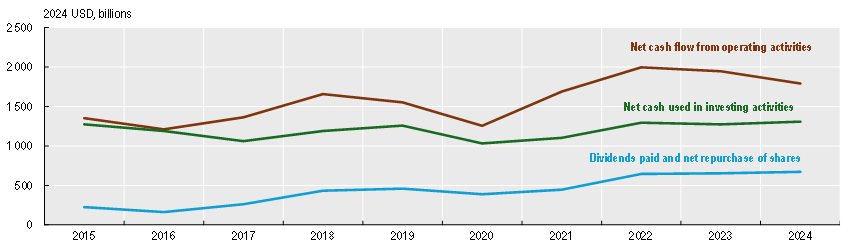

The energy sector’s impact. Tackling GHG emissions will require substantial investment in alternative technologies to replace the combustion of fossil fuels. Between 2015 and 2024, the net cash flow of listed energy companies from operating activities increased by 32%, enabling them to triple dividend payments and share repurchases, while net cash used in investing activities grew by less than 5%. Measures could be implemented to ensure a robust pipeline of bankable energy projects, encouraging firms to allocate a greater share of capital to new investments.

Listed energy companies – disclosure of scope 1 & 2 and scope 3 emissions in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

Link to the full blog post can be found here and link to the full report can be found here.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.