Demand and Trend Analysis of Banana Flour in Japan: Market Set to Reach USD 16.3 Million by 2035

The banana flour market in Japan is experiencing steady growth, driven by rising demand for gluten-free and functional food alternatives.

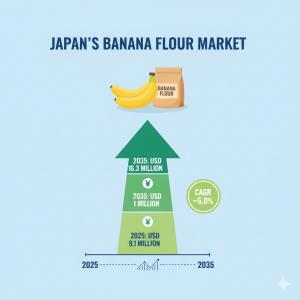

NEWARK, DE, UNITED STATES, September 5, 2025 /EINPresswire.com/ -- The banana flour market in Japan is on an upward trajectory, signaling exciting opportunities for both established manufacturers and new entrants. According to the latest report “Demand and Trend Analysis of Banana Flour in Japan: Size and Share Forecast Outlook from 2025 to 2035”, sales of banana flour are estimated to reach USD 9.1 million in 2025 and are projected to expand to USD 16.3 million by 2035, reflecting a CAGR of 6.0%.

The shift reflects a growing appetite among Japanese consumers for healthier, gluten-free alternatives and the increasing integration of banana flour into mainstream food applications. Rising per capita consumption, particularly across regions such as Kanto, Chubu, and Kinki, is positioning banana flour as an essential ingredient for health-driven culinary innovation.

Quick Market Highlights

• Market Value (2025): USD 9.1 million

• Forecast Value (2035): USD 16.3 million

• CAGR (2025–2035): 6.0%

• Leading Source (2025): Conventional banana flour (95.3%)

• Leading Application (2025): Food industry (70.4%)

• Fastest-Growing Regions: Kyushu & Okinawa, Tohoku

Regional Consumption Driving Expansion

By 2035, Kanto is expected to lead with USD 3.8 million in sales, followed by Chubu (USD 3.2 million), Kinki (USD 2.9 million), Kyushu & Okinawa (USD 2.7 million), and Tohoku (USD 2.1 million).

• Kyushu & Okinawa showcase the highest growth rate (6.8%), supported by tropical cultivation and tourism-driven food innovation. Banana flour is finding its way into local snacks, home baking, and even festival-inspired souvenirs.

• Tohoku follows closely with 6.5% CAGR, leveraging agricultural diversification and community initiatives to drive awareness. Local cooperatives are partnering with manufacturers to embed banana flour into daily staples.

• Chubu benefits from its industrial food manufacturing base, fueling innovations in banana flour cakes, noodles, and snack bars. Its strategic distribution links make it a strong growth hub.

• Kinki stands out for artisanal and fusion cooking. Upscale restaurants in Osaka and Kyoto are experimenting with banana flour-based desserts, tempura, and baked goods.

• Kanto, Japan’s consumption hub, combines high incomes with retail reach, allowing banana flour to enter mainstream supermarkets, hypermarkets, and e-retail platforms.

Conventional Flour Dominates, but Organic Gains Ground

By source, conventional banana flour processing accounts for 95.3% of total sales in 2025. This dominance is attributed to cost-effectiveness, established supply chains, and efficiency in large-scale processing. Manufacturers are further investing in advanced drying and milling technologies, improving consistency and extending shelf life.

In contrast, organic banana flour (4.7%) is a niche but expanding segment, targeting premium health food consumers. Growing awareness around organic certification and clean-label products is fueling steady momentum.

Food Industry Applications at the Forefront

The food industry accounts for 70.4% of banana flour sales in Japan, driven by bakery, snacks, infant food, and sauces. Banana flour’s versatility as a binding agent and gluten-free alternative is helping manufacturers innovate across diverse applications.

• Bakery & Snacks remain the largest sub-segment, as gluten-free recipes gain traction in home kitchens and foodservice outlets.

• Infant food formulations are emerging as a high-potential niche, with manufacturers enhancing nutritional profiles by incorporating banana flour.

• Beverages such as protein shakes, smoothies, and tea blends are tapping into natural nutrition and clean-label trends.

• Pet food is projected to grow above 8% CAGR, reflecting Japan’s booming premium pet nutrition industry.

• Household use continues to rise among health-conscious families, home bakers, and gluten-free adopters.

Rising Health Consciousness and Consumer Preferences

Banana flour is gaining popularity particularly among urban, health-focused families and those seeking gluten-free alternatives. While the product still carries a 15–20% premium over wheat flour, improvements in processing efficiency and supply chain networks are making it increasingly affordable.

The demand surge is further fueled by:

• Social media and culinary influencers showcasing banana flour recipes.

• Cooking shows and fusion restaurants integrating banana flour into pasta, pancakes, and traditional Japanese dishes.

• Retail penetration expanding from specialty stores into supermarkets and convenience stores.

Competitive Landscape: Established Leaders and New Entrants

The Japanese banana flour market is a dynamic mix of international suppliers, domestic manufacturers, and retail private labels.

• Natural Evolution continues to expand its organic and conventional banana flour offerings, partnering with health food retailers and moving into mainstream grocery.

• Pereg Gourmet Spices recently launched gluten-free pancake mixes and baking blends using banana flour, targeting convenience-seeking consumers.

• Kyowa Hakko Bio Co., Ltd. is leveraging biotechnology to enhance nutritional properties, particularly for infant foods.

• Taiyo Kagaku Co., Ltd. focuses on industrial-scale consistency, supplying manufacturers with standardized formulations.

• Japan Overseas Corporation plays a significant role in bridging international supply chains with local markets.

Retail giants like Aeon (TopValu) and Seven & i Holdings (Seven Premium) are introducing private label banana flour products, intensifying competition and improving accessibility.

Outlook: Opportunities for Growth and Innovation

The future of banana flour in Japan lies at the intersection of health trends, food innovation, and regional expansion. While conventional processing remains dominant, the gradual rise of organic and premium products points to a diversified growth trajectory.

Request Demand and Trend Analysis of Banana Flour in Japan Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-18237

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Manufacturers—both established and new—have an opportunity to:

• Innovate through product diversification (snacks, noodles, beverages, pet foods).

• Expand distribution into mainstream retail and e-commerce.

• Leverage regional strengths such as Kyushu’s banana cultivation and Kinki’s culinary heritage.

• Invest in processing technologies to lower costs and improve quality.

With per capita consumption expected to rise from 0.8–1.2 kilograms in 2025 to 1.4–1.8 kilograms by 2035, banana flour is no longer just a niche product but a mainstream functional ingredient reshaping Japan’s food landscape.

Explore Related Insights

Banana Flour Market: https://www.futuremarketinsights.com/reports/banana-flour-market

Korea Banana Flour Market: https://www.futuremarketinsights.com/reports/demand-and-trend-analysis-of-banana-flour-in-korea

Green Banana Flour Market: https://www.futuremarketinsights.com/reports/green-banana-flour-market

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.